Home

Forecast Contracts are live for trading

Trade Your Predictions on Government, Economic and Climate Events

Take a position on key government, indicators, and trading events with IBKR ForecastTrader. Users can trade yes-or-no predictions in different categories, including government, economics, finance and climate indicators. Trading is available around the clock, six days a week.

You will also earn 3.14% APY on your investment with an interest-like incentive coupon.

Already have an IBKR account? Log in

Live Stream with IBKR Senior Economist Jose Torres

Market Insights

January Producer Price Index - February 12 at 8:15 am ET:

IBKR on X

•

IBKR on Linkedin

•

IBKR on YouTube

December Durable Goods Orders En Español - February 18 at 8:15 am ET:

IBKR on X

•

IBKR on Linkedin

•

IBKR on YouTube

February Consumer Confidence - February 24 at 9:50 am ET:

IBKR on X

•

IBKR on Linkedin

•

IBKR on YouTube

The displayed future outcome probabilities and prices are hypothetical and only intended as an example. They do not reflect current market sentiment, expected outcomes, or the opinions of IBKR.

Displayed outcomes and prices are based on real-time market sentiment from ForecastEx LLC, an affiliate of IB LLC. For more information see ibkr.com/realfex

Gain Exposure

While Limiting Risk

Forecast Contracts let you invest in government, economic, finance and climate trend predictions while limiting your risk. The maximum loss per contract is limited to the amount you initially paid.

For each Forecast Contract you hold that expires “in the money” regarding the underlying settlement value, you receive a fixed payout of USD 1.00. Your max profit per contract is USD 1.00 minus the contract cost, fees and commissions. Forecast Contracts are priced between USD 0.02 to USD 0.99 per contract and quoted in USD 0.01 increments.

You can close open positions by buying the opposite side. For example: if you own a YES contract, you can close the position by buying a NO contract on the same underlying question.

Zero Commissions on Forecast Contracts

Forecast Contracts are offered at zero-commission at Interactive Brokers.

Forecast Contracts Offer Payments Equivalent to Interest in the Form of an Incentive Coupon – Current Rate is USD 3.14% APY

Forecast Contracts pay an interest-like incentive coupon based on the closing market value of the positions. The incentive coupon accrues daily and is paid monthly. Incentive coupons are currently paid at a rate of 3.14% APY.

Example: If you purchase a position at USD 0.50 and the market closes at USD 0.50, the daily incentive coupon will be based on USD 0.50. If, on the following day, the market for the same contract closes at USD 0.70, the daily incentive coupon will be based on USD 0.70.

Access Forecast and Prediction Markets 24/6 Across Our Professional Platforms

Use our desktop, mobile and online trading platforms to monitor your existing positions or search for new Forecast Contracts.

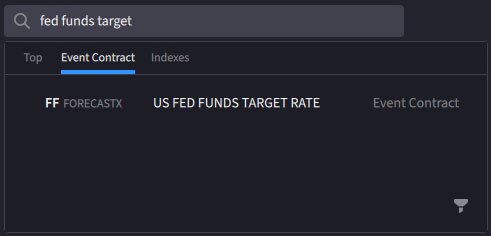

Enter search terms such as 'US Real GDP,' or 'Fed Funds Target' to return relevant contracts, and then select the forecast contract you wish to trade.

Toggling between trading platforms is seamless, and you do not need to log in or out as you move between them.

For detailed info on accessing Forecast Contracts on TWS, IBKR Mobile and Client Portal, see below under Already an Interactive Brokers Client.

Interested in Trading Forecast Contracts

at Interactive Brokers?

New to Interactive Brokers? Open an Account.

Interactive Brokers (Nasdaq: IBKR) is an automated global electronic broker that serves individual investors, hedge funds, proprietary trading groups, registered investment advisors and introducing brokers.

Our four-decade focus on technology and automation allows us to provide our clients with a uniquely sophisticated, low-cost global platform for managing investments.

Our clients enjoy low-cost access to stocks, options, futures, currencies and bonds from a single unified platform.

Already an Interactive Brokers Client?

Request trading permissions if you don't have Forecast/Event Contract trading permissions but would like to trade Forecast Contracts.

Trading permissions are usually approved immediately.

Trading on IBKR ForecastTrader

- Log in to IBKR ForecastTrader

- Select a Forecast Contract

- Click on YES or NO to trade

- To search for Forecast Contracts, select the Markets menu and enter a description of a product

(e.g., "US Fed" for US Fed Fund Rate, "cons" for Consumer Price Index, etc.)

Trading Forecast Contracts on Other Trading Platforms

Forecast Contract positions are available for review from any of our trading platforms.

You can also seamlessly access IBKR ForecastTrader from our other trading platforms. Click a trading platform to learn how.

In the Mosaic Layout - Select the New Window menu icon and select IBKR ForecastTrader

In the Classic TWS Layout - Select the Trading Tools menu icon and select IBKR ForecastTrader

Alternatively, you may search for Forecast Contracts by entering a product description (e.g., "Consumer Price") into a Watchlist or the Help/Ticker Lookup field, selecting the Event Contract radio button to refine the results, and then choosing the appropriate contract.

Please note that TWS now supports the use of ScaleTrader, Accumulate/Distribute, and IBALGO+Accumulate/Distribute for Forecast Contracts.

Use the Search box at the top of any page to search for Forecast Contracts by entering a product description (e.g., "Consumer Price"). Click the Event tab and choose the appropriate contract.

Select the Trade button and select IBKR ForecastTrader.

Alternatively, select the Trade button followed by the search box at the top of the page. Enter a description for a product (e.g., "temperature") and choose the appropriate contract.

Select the Trade tab and select IBKR ForecastTrader.

Alternatively, enter a product description (e.g., "unemployment") in the Search field, select the Event menu option, and then choose the appropriate contract.

To navigate back to Client Portal, select Trade stocks, options, futures, and more at IBKR Client Portal button in the top left corner.

The TWS API now supports the trading of Forecast Contracts. Please view our documentation for more details.

Select the Forecasts tab and choose the appropriate contract.

Alternatively, select the Explore tab followed by the search box at the top of the page. Enter a description for a product (e.g., "temperature") and choose the appropriate contract.

Forecast Contracts are only available to eligible clients of Interactive Brokers LLC, Interactive Brokers Canada Inc., Interactive Brokers Hong Kong Limited, Interactive Brokers Ireland Limited and Interactive Brokers Singapore Pte. Ltd.